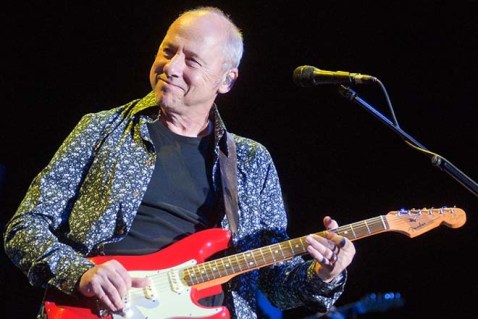

Marginal costs and revenues – at a Mark Knopfler gig

Twenty five years ago, I first saw Dire Straits live in Dublin. It was one of the first gigs I ever went to. Back then, there was a guy on O’Connell St in Dublin selling bootleg cassettes of live gigs for maybe £5. The quality was awful, but fans loved it. And it was illegal of course, making it all the more fun.

Move forward to 2015, and I was lucky enough to see Mark Knopfler live in Leipzig. Still an amazing guitarist. Of course, times have moved on and almost everyone has a smartphone to record a gig on – I hate doing this, but some artists don’t seem to mind. To my surprise, Knopfler in his 2015 tour not only seemed to encourage recordings at gigs, but found a way to make some extra revenue.

At each gig – including Leipzig, and yes, I did buy – you could download the actual gig recording for €15. This was sound desk quality, and unique. Add an extra €20 and you got the recording posted to your home on a souvenir USB stick.

Now think of this in marginal costs and revenues. The marginal cost is close to zero, as the stadium is fitted out, staff there and the sound desk set up. Maybe the only cost is a bit of rented space on a cloud server somewhere. On the revenue side, it is pretty much a no-brainer really – the full amount of the €15 per download is revenue, as I just argued the cost is close to nil. So if 1,000 fans at each gig buy the recording, that’s €15,000 x maybe 20 gigs = €300,000, a tidy sum. And of course, it is a legal recording 🙂

Some proof reading tips

Proof reading your own writing is a pain – even though it is something people like me have to do on a daily basis.

Proof reading your own writing is a pain – even though it is something people like me have to do on a daily basis.

So what are my tips. My first tip would be to pay a professional if you can, but even that does not eliminate the need for you to do some proofing yourself. A nice article from AICPA gives some good tips, and it is worth a read. One tip given is to read out loud. This would actually be my second tip and something I practice a lot. If you read out loud and the sentence sounds wrong, then it probably is wrong. Also, if you run out of breath, the sentence is too long.

A third tip, is an obvious one, run a spell check. It’s amazing how many people do not.

And finally, try to put yourself in the mind of the reader. Would your writing make sense to them? I often ask students to consider would their grandparents understand what they write. This helps to keep it simple and to the point.

Now, here is hoping there are no typos in this 🙂

What management accountants think about sustainability reporting

I have written before on sustainability, and it is a tricky topic to define and pin down. However, one thing that helps bring any issue to the fore is to measure and/or report on it. Many companies do report on sustainability and environmental issues. Whether such reporting is genuine or “green-washing” is another debate.

CGMA recently conducted a global survey of management accountants, and the report can be found here. A nice infographic of the key points can be seen here in the December CGMA magazine. One of things that jumped out at me was that the highest perceived benefits of reporting on sustainable issue came from management accountants in Africa. The report/survey suggests that management accountants are very aware of the need to report on sustainability and note it is beneficial. It also surprisingly suggests that the greatest barrier to reporting is no demand from decision makers.

Image from susdevafrica.net

Dealing with business ethics

Ethics is something accountants – and business managers in general – need to be not only aware of, but actively apply. But what is ethics and how do you make an ethical decision!

In simple terms, ethics in a business means doing the right thing. Easier said than done in some cases. Obviously, complying with laws of the land is one thing that would be ethical to do. But have a look at my previous post, where short and long term come in to play.

Rather than me continue on ethics, here is a great CGMA resource which  covers the topic very well.

covers the topic very well.

A challenge to Ireland’s banks – I’d love to hear your comments

To this audience I ask two questions

- do you understand short-term versus long-term? If you do, which applies to your decision-making?

- are there any trained management accountants working in banks? I know there are, so read below if you are one of them.

While driving back from Cork recently, I heard a decent sounding lady with six kids telling a story about how a bank was repossessing the house her family rented – it was the Joe Duffy show on RTE Radio 1. The landlord could not afford the loan repayments it seemed and the bank wanted to sell the house. The family worked, and had sufficient income to pay rent into the future. The husband worked in a state-job, so as secure as you could get. She tried to communicate with the bank, but got a “computer says no” type response from the bank. To me, and I am just a management accountant, not a banking expert I could not see the logic in selling the house. Something instinctively told me taking a longer term view is a better choice.

Based on the information she gave during the radio show, when I reach my home I opened an Excel sheet. I checked the rent the lady might be paying – from daft.ie – and then I started to use the simple PMT function in Excel. I made assumptions that the landlord stopped paying the bank loan based on the original house value in 2010; that the bank would allow the lady to take over the mortgage at the present market value of the house and at the present interest rate. I did not adjust for the time value of money. You can see all my workings at this link:

The total time to do the above calculations was about 20 mins. I admit, Excel is not perfect, and I do not adjust for the time value of money – I don’t think it will make things vastly different. To keep it short, if the bank allowed the lady to take over the house as described above, they would gain to the tune of just under €86,000. Based on my simple calculations, the lady could afford to pay this. So, taking a longer term view, the bank (and by definition it’s shareholders) would benefit compared to ditching the house now.

Some further points on costs. I ignore legal costs, as the bank would have to suffer legal costs on either a sale or re-mortgage. But there is a bigger elephant in the room on costs. The lady would be homeless, someone would have to pay this cost – directly or indirectly, and ultimately the state. If I extrapolate the social costs, what is the family (who seemed decent) became homeless, the family fabric was disturbed and the kids turn to crime in the future. How much would this cost in money terms ?

So back to my questions. The scenario I describe above is being repeat all across Ireland. As a person, and an accountant this annoys me. The view of banks seems to be short-term only, driven by profit only. Now don’t get me wrong, profit is good, it creates jobs and investment. But we must not view profit from a short-term perspective. So, to the bankers, give me an answer to the above questions. If you are a trained management accountant, you should be thinking long-term, and if not, don’t think you cannot fail by taking short-term views. As you know banks have failed, as the leading image here should remind you.

Plastic bag taxes – and the costs saved

It’s 13 years since Ireland introduced a plastic bag levy of 15c, then 22c. Since then, around €200m has been collected from consumers. England recently introduced a similar scheme and this prompted me to reflect on what the less use of plastic bags has meant for Ireland – with a cost/accounting angle of course.

The first thing that strikes me is the lack of plastic bags stuck in hedges. Not only does this mean a cleaner countryside, but much lower clean up costs for local councils.Second, I would say the packaging industry did not lose out, as paper bags are generally available in stores – cost neutral in terms of employment. This is good too as paper is renewable, but also lost people have a car boot full of reusable bags. I still have some dating back to 2002 believe it or not. Third, as a tax it worked in that it changed our behaviour as a nation – for the good of the exchequer and the environment.

Another cost overrun example

Following from my last post, here is another example of costs and design problems -but this one is a real project. A bridge crossing the Bay Area in San Franciso had an original cost estimate of $250, but the final cost was in excess of $6 billion. This occurred for many reasons, bad cost estimates, politics and the length of time involved. Read the article at the link for full detail – it’s a great example of the cost problems associated with infrastructure projects.

Why accountants and designers should work together.

Marketing and design people tend to be very creative, and fair play to them, it’s part of what they are. But design is one thing and actually building or making sometime is tougher – if you have ever built even a standard house you will know what I mean.

Marketing and design people tend to be very creative, and fair play to them, it’s part of what they are. But design is one thing and actually building or making sometime is tougher – if you have ever built even a standard house you will know what I mean.

The one thing I have learned about design of products is to not change the design after you agree it – this typically causes costs to go upwards. If a customer is willing to pay for this great, but that’s usually the exception.

My experience of product design is it is best to involve someone with good management accounting knowledge from the outset. This person need not be an accountant, but must has good knowledge of costs and or processes to build or make the final product. Otherwise big surprises can occur.

Maybe it’s an extreme example but take the main stadium design for the 2020 Olympic Games in Tokyo. According to reports, the cost of the design to be built has doubled to $2 billion since inception. Surely if someone with half decent knowledge of costs working with the designer would have spotted the additional costs.

Saving €13.3m annually on water….

Image from woodiesdiy.com

You may or may not know that Ireland has only recently started to charge for domestic water use. There has been some heated debate, but here are some simple numbers based my own household.

With two simple water butts – small 100l capacity costing about €60 In total (see the photo above) – I have saved at least 6,000 litres of water in the past year. At the metered rates this is not a lot saved financially, about €22. But if half of Irish households did this (about 600,000 houses) that is a total of €13.32 million per annum across the country. Not to mention how I have seen my kids get instilled with the idea of conserving water.

Of course that’s only half the story. Saving water from rainfall means less produced water, less stress on infrastructure, less energy consumed and so on. I have no idea what these effects would do to my savings figure above – certainly a multiplier.

Typical accountant you may be thinking, but that’s it, we need to think not only about costs we pay for water, but other costs too.

Accounting and big data

In my view, even though some accountants may not agree, big data will effect how accounting is done. This is particularly true for management accounting.

I was going to write an outline of my thoughts on big data and management accounting, but I found this great post on diginomica. It gives some really good practical insights. It notes how the following, for example, gets accountants interested in big data- it is being used to:

- Improve the quality of budgets, plans and forecasts

- Enhance top line revenue

- Reduce operational costs

- Detect fraud

- Assess the viability of a company as an on-going concern

Improving working capital

Working capital is defined as current assets less current liabilities. Current assets are inventory, receivables and cash, while current liabilities are amounts owed to suppliers, bank overdraft and other short term liabilities such as taxes due.

Managing working capital is very important. Tie up too much money in inventory and the business is in trouble. A recent report by PWC suggests companies are still not managing working capital as best they can. Read about it and some suggestions to improve working capital here.

A simple definition of management accounting

When some one asks me for a simple definition of management accounting, I typically say “the provision of decision-making information to managers”. This in my view covers all aspects of what a management accountant typically does, be it the provision of financial or non-financial information, short or long term view etc. Of course, some management accountants are also decision-makers, for example when they occupy a CFO role in a large company for example.

I don’t know if I should be surprised or not, but I read an old article from the Irish Times of 22 January, 1971 (by C Power) – a few years (but not many) before my time. The article was giving career advice to budding accountants of that time. I quote:

” A more specialist sector, however, is the cost accountancy field. This is a key area – indeed cost accountants are often referred to as management accountants because of their function of providing accounting information to aid management decisions”

The bit is bold is above is not that dissimilar from my simple definition I guess, with the exception being the maybe narrower word “accounting” as part of the definition. I do like simple definitions, as they often do stand the test of time.

(More) sustainable beer – and some cost savings

As you can imagine, large drinks or brewing companies use a lot of water. Here is a nice article on what Heineken had done on the last five years – saves water and over €70million.

Management accountants and technology change

Changes in technology is regularly a top issue for management accountants when asked. Of course in recent years, the pace of technology change has been so rapid compared to previous. How can management accountants deal with such change? An article from the CGMA provides some useful tips.

Why media reports on profits annoy me a little….

Ryanair made a profit of €865 million in 2014. The Irish Times reports this figure and also notes “operating profits rose 65 per cent to €1 billion from €658 million”. Great news for Ryanair. The main reasons for increased profit seem to be a combination of lower fuel costs and increased passenger numbers. What sort of annoys me about such media reports – and all media seem to do this, not just the Irish Times – is that such reporting of numbers does not tell the full story.

Let’s take a brief look at more detail. In this example from Ryanair (or any company) on profits, we also need to consider the level of investment in assets. Forgetting about accounting for a moment, it is logical to think that if Ryanair for example acquired more aircraft, then it should be able to generate more profits due to increased passenger revenue. But, if we just make a statement like “profits rose by 65%”, this does not reveal the underlying assets.

The same Irish Times article reports that net assets (assets less liabilities) did in fact rise from €3.3 billion to €4 billion in the year. If we do a simple return on assets calculation (using operating profits), then for 2013 the return is 658/3300 = 19.9% and for 2014 it is 1000/4000, or 25%. This is a year on year increase in the return on assets of about 26%. This is a long way off the 65% reported increase in operating profit, and a lot more meaningful as it reflects the net assets (or capital) used. It is still a great improvement, but perhaps not so sensational a 65%!