A quick lesson on blockchain for accountants: Part 1 – currency

I have been meaning to write something on blockchain for quite a while now. So, in this post and the next few, I will write what I hope are some simple lessons which will give you an appreciation of blockchain. To do this, I want to go back to some basics first and here I will remind you what a currency is. For these posts, I will use the example of a blockchain being used in cryptocurrencies, but there may be many other uses as time goes on.

I have been meaning to write something on blockchain for quite a while now. So, in this post and the next few, I will write what I hope are some simple lessons which will give you an appreciation of blockchain. To do this, I want to go back to some basics first and here I will remind you what a currency is. For these posts, I will use the example of a blockchain being used in cryptocurrencies, but there may be many other uses as time goes on.

So what is a currency? We probably all think we know what it is, it is the money in our pockets. That is a fair starting point, but we need to big a little deeper. In accounting – see for example the IASB’s Conceptual framework – there are several measurement bases: current cost, historic cost, present value, realisable value. The conceptual framework of the IASB defines measurement “as the process of determining the monetary amounts at which the elements of the financial statements are to be recognised and carried in the balance sheet and income statement”. Monetary means in money, and money can be defined as a current medium of exchange – hence the word currency. So, for accounting, this means we measure assets, liabilities, incomes and expenses in currency – a dollar, a euro, a pound. So why not in bitcoin, or litecoin or ethereum? Are these not currencies?

To answer these questions, let me divulge for a moment. When I was in secondary school, I studied “Business Studies”. From this, I remember something which used to be printed on all the Irish pound notes before we had the Euro, the term legal tender. I also recalled that all pound notes were legal tender, and a certain amount of coinage. Legal tender means that the currency is acceptable as a means of settling a debt. In Irish law, before the introduction of the Euro, a 1969 law set out that all notes and some coinage were legal tender e.g. a debt of £20 could be paid in coins of 10 pence or greater. The concept still applies to the Euro notes, and in other currencies too. However, being legal tender only means something is an acceptable means of payment, it does not have to be accepted in general. Thus, cheques, credit cards, PayPal, ApplePay, and guess what you got it, cryptocurrencies, do not have to be accepted as a form of payment. Having said that, typically banknotes are issued by a country’s central bank and are nearly always accepted.

So, if something is not legal tender, then there is a chance they may not be accepted as a method of payment (i.e. settlement of a debt). At this stage you are thinking, but if credit cards etc are not legal tender why are they so widely accepted? The answer lies in the fact that the banks who issue the cards and process payments are doing so typically in a currency recognised as legal tender.

Let me pose a question now. If you went to a typical shop in a town or city, and you had some cryptocurrency, maybe bitcoin, in an electronic wallet would you be able to pay for a coffee? The answer is generally no, but there are some online and other retailers who will accept payment in bitcoin. So it is probably fair to say that as bitcoin is not generally accepted (yet), it is not a currency. And, as far as I am aware, no cryptocurrency is yet legal tender. For accountants, this means that we are not yet measuring in cryptocurrency, and no accounting reports will be prepared in bitcoin for example. Thus in accounting terms, any cryptocurrency a business may have is treated as an asset in the financial statements – typically a current asset, like a normal bank or cash account. Of course, cryptocurrency values seem to be rather unstable, but this is not something I cover here.

Now that you know what a currency is, Part 2 of this series of posts will explore how bitcoin payments are processed.

A faulty income statement, or not?

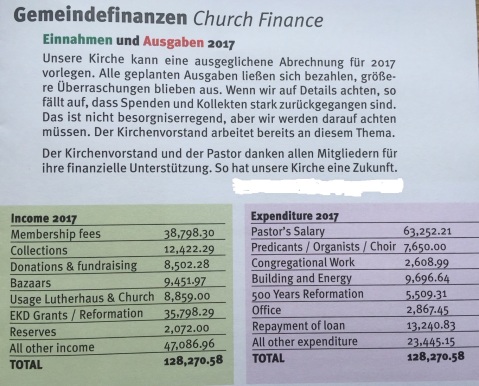

Or a profit and loss account if you like the older term. Below is simple income statement (which has been published in the public domain), or more precisely an income and expense account, which is a term often used in clubs and charities. So, this example if not IFRS based, but the basic principles are the same. To be fair to the preparer of the statement below, it is quite detailed and transparent. But there is one problem – can you spot it? (“Einahment und Ausgaben” could translate as income and expenses or receipts and payments, but I will come back to this below).

Just to remind you, accounts are generally prepared using the accruals concept, but in smaller organisations like churches and charities, using a cash basis is common. Have you spotted what is seemingly incorrect? It is under the “expenditure heading”. Got it? It is the “repayment of loan”. This is a repayment of a capital item, or capital expenditure. Remember that only revenue expenditures appear as expenses in an income statement, so in the case of a loan only the interest on the loan would be included. So is the above statement incorrect? The answer is probably not, but now back to the nuances of language. The statement above is probably best described as a “receipts and payments” account, as it seems to be more representative of cash coming in and going out. We would need to have a chat with the preparer to be sure. However, including the loan repayment is a pointer that the above is not an income statement/profit and loss. This fits too with the nature of the organisation (a church).

You might also notice “reserves” on the income side of the statement above. Again, this is likely a capital item, and maybe should not be included as income. We would need more detail to be sure.

Accounts payable controls

Image from businessfamilyfirst.com

I can remember my time working in a manufacturing company as a financial controller and later a systems manager like it was yesterday. One of the great experiences I had was working with and configuring SAP.

One thing it changed in the company was the Accounts Payable (AP) process. My company at that time was quite good at ensuring only genuine suppliers were created. But that’s been newly 15 years ago now and I know the AP processes have become even more automated.

So this article in the Journal of Accountancy really interested me. It seems proper AP controls evade some companies still, but when managed well add to the bottom line. Have a read of the full article

The charity sector – the accountability conundrum.

Some recent media coverage of problems in the Irish charity sector has been quite detailed. In one case, a charity founder was clearly exerting a lot of control and taking money for personal use. In another, a group of people on social media demanded detailed accounting and controls in a charity with only a single permanent staff member.

In both cases, and there seems to be a lack of accountability as regards to how money was spent. The first case was to me simply fraud, but the second case is probably more typical of the issues faced by smaller charities in Ireland and other countries. That charities be held accountable for what they spend if of course right and proper, but to do so they require accounting and contol systems. These systems do not come free of charge. For example, even to have one qualified accountant in a charity would cost in the region of €70000 per annum. This may a considerable portion of the income of a smallef charity and herein lies the conundrum – the public want accountantability, but they also want administration costs to be minimised. What’s the answer to this conundrum? Well, I am not sure, gut the answer may lie in simple economies of scale – that is, perhaps there are too many smaller charities who could consolidate. Or possible governments or some regulatory agency could provide shared service type accounting arrangements for charities.

Teaching accountants

On a recent research project I read an article from 1914 which was written by an “old” accountant of the time. On testing accounting students knowledge through examinations (s)he notes “we see interesting problems set out in symmetry and order”. This made me think about what has changed today.

Indeed we still use examinations in university and in professional bodies. They are a good tool to test knowledge, and increasingly examinations draw on methods such as case scenarios which are less structured in an effort to imitate real life scenarios. However, no matter what we do as teachers, we cannot replicate the real world. This is of course where professional development and on the job training come in. I do hope we at least provide the basic knowledge to help students hit the ground running when they start their careers. We can only improve the value of this basic knowledge by trying to get students to use their knowledge in an unstructured way. In an examination scenario, this means we need to use fresh ideas and new ways to ask standard material – this can be tricky sometimes, but it helps both students and us teachers to apply ourselves in a more real world fashion.

Anglo Irish Bank – the circular transaction explained.

My colleague Michael Farrell has written a nice post explaining the dodgy accounting transactions at Anglo Irish Bank – the bank that was a big part of the Irish financial crisis in recent years.

Movies featuring accountants/accounting

A few weeks ago, the annual Academy Awards took place. At some point in the run up to the awards, I found a nice post by Cheryl Meyer in the Journal of Accountancy. The post “5 films to inspire CPAs” was not only a reminder of some great movies, but also a reminder of the varying and broad role accounting and accountants play in society.

On favourite on the list is The Shawshank Redemption. If you have never seen it, do. The lead character Andy Dufresne (Tim Robbins) makes life a little more comfortable for himself while serving time through doing tax returns for prison officers and keeping accounts of the Warden’s corrupt dealings. The good accounting allows Andy to take all the corrupt cash for himself on his escape from prison.

My second favourite is The Untouchables. The model used to imprison Al Capone in this movie is still widely used today – get the criminals on tax laws or “lack” of earning to match their lifestyle. For example, the Irish Criminal Assets Bureau uses this concept quite effectively. I’m a big Sean Connery fan too!

The versatility of gross profit margin

You may know the gross profit margin ratio, which is:

Gross Profit x 100

Sales.

Gross profit is: Sales – Cost of Sales

and

Cost of Sales = Opening inventory + Purchases/cost of production – Closing Inventory.

In this short post I would just like to share some of my experiences on the versatility of this simple ratio. If we look at the elements of the ratio, it is easy to see that if each element remain stable, the answer should also be stable. So for example, if I buy something for €40, sell it for €100, then my GP margin is 60%. If my sales price or purchase price changes, then the GP margin changes. Then, if we think about inventory levels, if these fluctuate the GP margin changes too. Taking all this together, it’s easy enough to see how any business typically knows what its GP margin should be. Thus, if it varies considerably, there may be something wrong.

Here are two things I know the GP margin is used for. One, from my own experience, is in pubs/bars. Most pubs/bars are susceptible to fraud and controls typically put in place by owners. One such control is monthly stock-takes and monthly accounts. A fall in the GP margin could indicate “lost” stock or unrecorded cash receipts – which further controls may reveal. Another use is to spot inflated revenues. Businesses may want to make their profits look better and thus do things like invoice for goods early, before the end of a financial year. These good may not even be bought/made yet. Thus, the GP margin may be lower. Again further investigation is needed to find the issue.

There may of course be more simple reasons for changes in the GP margin – costs and sales prices may simply change and affect the ratio. But once these have been ruled out, it is a useful indicator.

Accounting for Bitcoin

We have probably all heard of the digital currency Bitcoin – there are some others but Bitcoin is the best known I think. I read a nice article on the Bitcoin magazine website recently which reminded me of the basic things us accountants need to consider if dealing in foreign currency or if a new currency comes along – it is not that long ago since the Euro came our way.

The article summarises well the three steps I experienced when operationalising the Euro more than a decade ago now. Like Bitcoin, the Euro was for me then a non-physical currency to begin with. The first “step” with the Euro and actually happening now with Bitcoin is use as a payment method. With the Euro, we had the ECU as a payment method first. In this case, the accounting entry is the same as any other payment method – such as a credit card or PayPal – all amounts are in local currency. Step 2 would be to treat Bitcoin as a foreign currency. In my experience this typically happens when volumes of payments to/from customers/suppliers become larger. For example, many Irish SME treat GBP as a foreign currency in their accounting systems, but treat the USD more like a payment method. As the articles notes, if Bitcoin is treated as a foreign currency then exchange gains and losses need to be accounted for. Step 3 is adoption as a base currency. This may not happen of course, only time will tell. Let’s assume it does happen, then the accounting system works pretty much the same as in step 2. The would also be some work in translating assets and liabilities to the new currency. With the Euro this was relatively simple as fixed exchange rates were agreed and then it was matter of running a routine within the accounting software to do the calculations.

As the article suggests, more businesses are accepting Bitcoin (as its stabilises in value) and thus are at step 1.

Accounting can be bad for your health!

The bookkeeping end of accounting can certainly be a bit dull – even if it is the source of much accounting data. Dealing with invoices, receipts and other bits of paper is an absolutely necessity – the promised paperless office is still awaited.

An article in Forbes recently surprised me though. Apparently the thermal paper used in many till and other receipts can be quite harmful to your health. Have full read here

Incomplete records

Sometimes a business does not keep (or have) proper records. Most countries require a business to keep accounting records by law, so in my experience the only time a business does not have records is when there is something like a fire, or records are lost or destroyed. When this happens, there are several techniques which can be used to help “build” a set of accounts. Here is a nice article from CPA Ireland which details some of these.

Taxing bitcoin

You may have heard of bitcoin, the online “currency” causing quite a stir in recent times. Unlike many other online payment systems, bitcoin is outside the normal banking and currency systems – see more here about its history etc.

Being outside the normal banking and currency systems means the value of a bitcoin is difficult to determine. And, without going into too much detail here, speculators have caused the value of bitcoin to rise.

So now for the tax bit. An article from the Wall Street Journal last December noted some difficulties the IRS (and other tax authorities I’m sure) are facing. First, is a holding of bitcoin an asset which might be subject to capital gains taxes? It may be, but the first thing one needs to value an asset is a value ideally based on a market or cost basis. This might be tricky with bitcoin, given that it is not a real currency and the market is unregulated. Second, could gains or losses be treated as income? This is probably workable, as a gain or loss could be recorded on sale of bitcoins. But normally, marginal income taxes are higher than capital taxes. This would be fine for the tax authority I am sure, but holders of bitcoins might argue for the asset option – and so might their tax advisors. Only time will tell which option will be used.

Artificial intelligence in Accounting

In the latter part of 2013, I noticed several new developments in cloud accounting software. I suppose one of the key advantages of cloud accounting software is that it allows the software provider to concentrate on what they do well, while at the same time allow other software providers to integrate with their products. And, some of these products include some level of artificial intelligence.

To give an example of a non-cloud product first, Irish firm OCRex use optical character recognition to help accounting practices do bank reconciliations when smaller clients don’t do this – see http://www.ocrex.com/home. This software reads scanned bank statements and reconciles opening and closing closing balances, and leaving the accountant with the job of checking for missing items only. Thus, this product is intelligent in that it matches items on the bank statement using amounts and other information like to a reference.

Now let’s take this idea to the cloud. Several accounting software products can now scan emails., faxes and scanned documents to determine not only the amount of a business transaction, but also determine what kind of transaction it is. For example, xero software offers an add-on which reads transactions and posts automatically to the correct expense account. From my understanding of the xero add-on, it also learns as it goes, learning what supplier is posted to which expenses account etc. This certainly has a lot of potential for small businesses, reducing processing time and storing documents in the cloud.

Cash accounting – an alternative to accruals accounting? And what about accounting software?

English: Accounting machine from UK manufacturer Powers-Samas. (Norwegian Technology Museum, Oslo.) (Photo credit: Wikipedia)

In Ireland and the United Kingdom (and maybe come other countries) it has always been possible for smaller business to pay VAT based on cash received rather than on an accruals basis. You probably know what the accruals concept is, but if not click here. When I teach accounting or prepare accounts, the accruals concept is used almost without exception. The profit & loss account (income statement) and balance sheet (statement of financial position) will definitely use the accruals concept. In fact, these financial statement often take a different name and format when prepared for a cash-based business. For example, when I teach how to prepare the financial statement of not-for-profit organisations such as clubs, we often refer to a “Receipts and Payments Account” and a “Statement of Affairs”. The former is like an income statement, but is based on cash records; the latter is a list of assets and liabilities and will normally draw on the accruals concept.

From April 1st 2013, the UK tax authorities permits smaller unincorporated businesses to use a cash based accounting scheme where the turnover is less than £77,000 (see here for more detail). I’m not a UK tax expert, but from my reading about the topic on the web, the “income” of a small business will be the cash received, and the “expenses” will be cash paid for business expenses. This sounds like a reasonable effort to simplify the tax system for the smallest of businesses. The accruals concept may not be that relevant to many of these businesses as, for example, they may have few assets (to depreciate) and receive payment for most work as soon as it is done. So all fine? Well apparently, many accountants protested this new scheme, and that’s not surprising given how the accruals concept is engrained not only in the teaching of accounting, but also in accounting regulations. As a management accountant, I would always encourage the smallest of businesses to think in cash terms – it is easier for business owners with little accounting skills to understand. But I do see one big problem with this scheme in the UK. It centres around what happens when turnover exceeds £77,000. Once this happens, the business must revert to accruals accounting. This would cause much confusion if a business is using accounting software. Normally, accounting software incorporates accruals accounting, but some also support cash accounting in the way described here. I’m not 100% sure, but I would imagine if you set up software to work in one method, it may not be that easy to switch. So even though this cash scheme is easier and optional for small UK business, if they use accounting software (and more and more do) then it is probably best to stick to accruals accounting.

What is depreciation?

Okay, the last two posts were about assets, and now I’d like to give a brief introduction to depreciation. As you may know the accruals concept (also known as the matching concept) sets out how revenues and expenditures should be matched against each other – when cash is paid/received is nots relevant. When a business buys a non-current asset, the accruals concept kicks-in. The asset itself is typically used by the business for several years, and thus generates revenue. So applying the accruals/matching concept, the cost of an asset needs to be matched against revenue over several years. How do we do this? Well, we depreciate the asset. This means the cost of the asset is spread over several years.

This raise two questions 1) how much per year and 2) over how many years? This is where certain assumptions are made. First, an estimated useful life of an asset is determined, for example from previous experience of a similar asset. Second, then business will attempt to assume whether the assets contributes to revenue earned equally over time, or more in earlier years for example. In the former case, the business might use what is termed the straight-line method – which charges an equal amount each year. For example, is an asset cost €10,000 and it’s useful life is 5 years, then the depreciation expense in the income statement each year is €2,000. On the statement of financial position, the asset value falls by €2,000 each year. If an asset is assumed to earn more revenue in earlier years, for example a motor van or truck, then the reducing balance method can be used. This method charges more depreciation in the earlier years. For example, if we assume an asset costs €10,000 and is depreciated at 10% reducing balance, here is what will happen:

Cost €10,000

Year 1 (1,000) x 10%

Balance 9,000

Year 2 (900) x 10%

and so on…

Thus, using the reducing balance method, the asset will still have a value in the accounts for many years, but the depreciation charge will be smaller each year. If you think about the total costs of owning a car/van/truck, the repairs tend to get higher as it gets older, so the reducing balance method reflect this too.