Building a better income statement – according to McKinsey

McKinsey have a nice web article which highlights the problems with GAAP reporting versus the needs of investors and analysts. The kernel of their article is that financial statements, with some small adjustments, could save investors a lot of re-working of figures. They provide the following example:

Two things come to my mind. First, in my first real management accounting job almost 20 years ago now, we prepared an income statement which was not too far away from the one on the right above. And, most management accounting courses would teach students to draw up some kind so similar profit statement – at least separating direct and indirect costs.

Second, the articles does not mention XBRL at all. With tagged data from GAAP financial statements, XBRL could re-draw financial statements in any format. I am not saying all XBRL tags are there to do what McKinsey suggest, but it is certainly possible technically.

You can read the full article at the link below. It is worth a read.

The cost of my time…

In November last year I wrote about hidden costs. You may have seen this story below doing the rounds in the internet. It made me stop to think for a while – a hidden cost of work perhaps!

“A man came home from work late, tired and irritated, to find his 5-year old son waiting for him at the door.

SON: ‘Daddy, may I ask you a question?’

DAD: ‘Yeah sure, what it is?’ replied the man.

SON: ‘Daddy, how much do you make an hour?’

DAD: ‘That’s none of your business. Why do you ask such a thing?’ the man said angrily.

SON: ‘I just want to know. Please tell me, how much do you make an hour?’

DAD: ‘If you must know, I make $50 an hour.’

SON: ‘Oh,’ the little boy replied, with his head down.

SON: ‘May I please borrow $25?’

The father was furious, ‘If the only reason you asked that is so you can borrow some money to buy a silly toy or some other nonsense, then you march yourself straight to your room and go to bed. Think about why you are being so selfish. I don’t work hard everyday for such childish frivolities.’ The little boy quietly went to his room and shut the door.

The man sat down and started to get even angrier about the little boy’s questions. How dare he ask such questions only to get some money?After about an hour or so, the man had calmed down and started to think:Maybe there was something he really needed to buy with that $25.00 and he really didn’t ask for money very often The man went to the door of the little boy’s room and opened the door.

‘Are you asleep, son?’ He asked.

‘No daddy, I’m awake,’ replied the boy.

‘I’ve been thinking, maybe I was too hard on you earlier’ said the man. ‘It’s been a long day and I took out my aggravation on you. Here’s the $25 you asked for.’

The little boy sat straight up, smiling. ‘Oh, thank you daddy!’ he yelled. Then, reaching under his pillow he pulled out some crumpled up bills. The man saw that the boy already had money and started to get angry again.The little boy slowly counted out his money, and then looked up at his father. ‘Why do you want more money if you already have some?’ the father grumbled. ‘Because I didn’t have enough, but now I do,’ the little boy replied. ‘Daddy, I have $50 now. Can I buy an hour of your time? Please come home early tomorrow. I would like to have dinner with you.’ The father was crushed. He put his arms around his little son, and he begged for his forgiveness.”

Happy Christmas

Well, that’s it for 2013. I wish you all a very Happy Christmas and a prosperous 2014. I’ll be back in the new year. Meanwhile, keep warm and safe.

Nollaig Shona Dhaoibh

Martin

Stick to the cooking – restauranteurs and accounting knowledge?

In October of this year, Michelin star chef Derry Clarke had a go at Dublin restaurants selling “cheap meals” – see here. I guess Clarke was thinking from his own view when he said “the number of restaurants offering meal deals at economically non-viable prices just isn’t sustainable, it’s the same cost in McDonalds, but we have all of the overheads”.

He may have a point about the number of restaurants being sustainable, but Derry, stick to the cooking. Any management accountant could figure out that even if meals are sold cheap (and I doubt they are below cost as Clarke suggests), they still make a contribution towards overhead costs. It would be better to have 50 guests in a restaurant earning a contribution of €5 a head (€250 in total) than having an empty restaurant. In the latter case, costs such as labour, heating, rent and so on are still incurred.

What is throughput accounting?

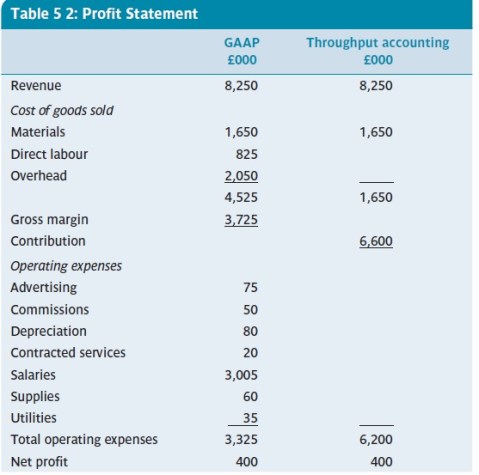

Throughput accounting is an alternative to traditional internal cost reporting. It stems from the Theory of Constraints, which I won’t detail here, but essentially this theory suggests an organisational can best achieve its goals (e.g. profit) by maximising it use of a constraining resource. A constraint could be machine capacity for example, and by maximising throughput on the constraint profit is maximised. To report on throughput, a new accounting approach is required, called throughput accounting:

1) Totally variable costs – this means a cost which is incurred only when a product/service is created. This often means only material costs. Labour costs are not totally variable, as employees are typically paid regardless. Some transportation or subcontracting costs may be totally variable. All overhead costs are not totally variable.

2) Throughput – this refers to revenue less totally variable costs. Contribution using throughput accounting is likely to be higher.

3) Operating expenses – this refers to all costs other than totally variable costs. Operating expenses are not distinguished into categories such as fixed or variable, or allocated to products in any way i.e they are similar to period costs, as they are costs which are more

associated with the passage of time than with products.

4) Net profit – in throughput accounting, the net profit is simply throughput minus operating expenses.

Looking at 1-4 above, you can see no attempt is made to allocate any overhead cost, so throughput accounting does not meet normal GAAP requirements. It does however raise the possibility of selling products/services at a price which is lower than under normal cost accounting, and it may also be useful for short-term decision making. Below is an example of a profit statements from Burns et al (2013. p. 112), which shows how throughput accounting produces a differing view on costing.

The overall net profit figure is exactly the same, but you can see a much bigger contribution under the throughput method. Arguably, as only material costs (in this example) are totally variable, a report such as the one above is very useful for short term decision-making.

References:

Management Accounting, Burns,Quinn, Warren & Oliveira, McGraw-Hill, 2013 – see burnsetal.com

What cost can you sell at?

In this post, I recount a conversation I had with a great mentor some years ago. It questioned my notion of what costs are relevant and how to set prices once a plant/factory is not at full capacity.

In a factory ( or any business perhaps ) when there is free capacity we can start to look at the make up of costs a little closer. Traditionally, management accounting would suggest we should at least cover all variable costs in the selling price. But think about it like this – if we have spare capacity, then perhaps the only additional cost is the material cost. Let’s assume we have a machine with a full crew, but not at full capacity. The fixed costs of the machine are just that – fixed, and we cannot avoid them. The labour costs are in effect fixed too, as workers will be paid. So, in this case, only the material costs are relevant. And this, any selling price above the material cost contributes to profit.

Yes, there may be many simplistic assumptions in the above. However, it made me think back then and I always give this example to my students. It is of course an example of throughput accounting, which I will mention next week.

Related articles

The Science May Be Settled, But the Economics Isn’t

A re-blog this week. This is a great post from the Freakonomics blog on the climate change debate – or fact perhaps more correctly. It makes interesting reading.

The Science May Be Settled, But the Economics Isn’t.

Related articles

Anyone can call themselves an accountant

Yes it’s true, anyone – in Ireland at least – anyone can call themselves an accountant. And, this has been the case for as long as I have been an accountant. I was reminded of this recently by an article in the Irish Times. To quote from the article:

“Don’t fret, because no qualifications are necessary to trade as an accountant. Anybody can open up a practice, no matter how innumerate they may be – there are no absolutely restrictions on the use of the term “accountant”. Remarkable, isn’t it?”

I guess it is remarkable. Yes, there are professional accounting bodies whose members must pass examinations and keep their training up to date. And yes, to be an auditor you must generally be a member of such bodies. But after that anyone can claim to be an accountant. As noted in the Irish Times, even an upcoming review and consolidation of Irish company law has failed (as yet) to include a provision of who can use the term accountant.

Related articles

- So, you think you are an accountant? (irishtimes.com)

Hidden costs – what are they?

The term “hidden cost” is one which we are probably quite familiar – the media like to use if a lot. But what is a hidden cost? Where do these costs hide? Can we avoid them in decision-making? Too many questions to answer in a single post, but let’s start with the term itself.

If you do a google search, you will get many definitions which define hidden costs as a similar concept to opportunity costs. I disagree with such definitions as if you have identified an opportunity cost, then it is not hidden is it? Ok, perhaps I am being a bit unfair here, but to me hidden costs are those which you may not foresee when making a decision. Of course, it’s never possible to foresee all costs when making a decision, but perhaps the hidden costs might emerge if more time is given to the decision – easier said than done in a business scenario.

Take the example of a house purchase decision. This is a big decision in anyone’s life, and we normally take the time to make the right decision on location, size, internal layout, price, amount to borrow and so on. After a few years in the house we might discover we are far from schools or work, or that it is hard to heat the house – these would be hidden costs of our house purchase as we probably did not factor them into our initial decision. There’s a good chance though that we would include such things in a second house purchase decision.

Product development and advertising costs

It’s probably fairly obvious that product development costs affect the overall profitability of any product. Some products like drugs and new technology incur huge development costs. New technology, at least at the consumer end, often incurs huge advertising and promotion costs too. And simply, if sales are not sufficient, then losses occur.

As an example, consider a report from the Irish Times on Microsoft’s efforts in the tablet market.

“Microsoft’s Surface tablets have yet to make any profit as sputtering sales have been eclipsed by advertising costs and an accounting charge, according to the software company’s annual report.

The two tablet models, introduced in October and February to challenge Apple’s popular iPad, have so far brought in revenue of $853 million, Microsoft revealed for the first time in its annual report filed with regulators yesterday.

That is less than the $900 million charge Microsoft announced earlier this month to write down the value of unsold Surface RT – the first model – still on its hands.

On top of that, Microsoft said its sales and marketing expenses increased $1.4 billion, or 10 per cent, because of the huge advertising campaigns for Windows 8 and Surface. It also identified Surface as one of the reasons its overall production costs rose.

The Surface is Microsoft’s first foray into making its own computers after years of focusing on software, but its first attempts have not won over consumers. By comparison, Apple sold almost $24 billion worth of iPads over the last three quarters.”

(Above is copyright of Irish Times/Reuters)

Data analytics – the human input

Big data is a big thing in the management accounting practitioner world, and in the professional journals too. I have previously written some posts on what big data is (see for example, here and here) and I have noted that humans are still needed to interpret data. Here’s a great example, below. Before I start, just keep in mind what I always say to my students about technology – technology within computing devices is essentially dumb, it is nothing more that a series of 0 an 1 which do exactly what we program it to do.

This post from CSO outlines how good analytic is essential. It cites an example of an analysis of social media to predict trends in the US unemployment rate. The analysis used twitter feeds and other social media. It attempted to identify key words such as “jobs” and “unemployment”. A huge spike in the number of tweets appeared. Why? Steve Jobs had just died, so the word “jobs” was all over social media. As a human, we can easily distinguish the meanings of words, but an automated analysis or word collecting tool cannot. I believe management accountants have a key role to play in such sense-making of business big-data – after all we know the business quite well.

Speed cameras business

In July this year (2013), I read an interesting brief news report about a speed van operator in Ireland. Yes, we all hate these guys, but the article made me realise this seems like a good business to be in – even if you are hated by motorists. According to the article, the GoSafe consortium makes a profit of almost €50,000 per week or €2.5m per year. It has almost €11m debt and is contracted to provide 6,000 hours per month to the Irish state. The article notes that at least one motorist per hour is caught speeding. I don’t know the ins and outs of the contract, but if the company makes a profit of €2.5m annually, even if it does pay out some dividends, the debt owing could be paid down quickly it would seem. The management accountant in me would really like to know what is the breakeven number of speeding motorists per day! You can read more at this link: http://www.rte.ie/news/2013/0720/463662-speed-vans/

A poem on tax

Punch cartoon (1907); illustrates the unpopularity amongst Punch readers of a proposed 1907 income tax by the Labour Party in the United Kingdom. (Photo credit: Wikipedia)

It’s Budget time in Ireland. I found this poem on tax on the internet a while back. It’s a bit political I guess, and perhaps US oriented, but it worth read.

“Tax his land,

Tax his bed,

Tax the table

At which he’s fed.

Tax his work,

Tax his pay,

He works for peanuts

Anyway!

Tax his cow,

Tax his goat,

Tax his pants,

Tax his coat.

Tax his tobacco,

Tax his drink,

Tax him if he

Tries to think.

Tax his car,

Tax his gas,

Find other ways

To tax his ass.

Tax all he has

Then let him know

That you won’t be done

Till he has no dough.

When he screams and hollers;

Then tax him some more,

Tax him till

He’s good and sore.

Then tax his coffin,

Tax his grave,

Tax the sod in

Which he’s laid.

When he’s gone,

Do not relax,

It’s time to apply

The inheritance tax.

Accounts Receivable Tax

Airline surcharge tax

Airline Fuel Tax

Airport Maintenance Tax

Building Permit Tax

Cigarette Tax

Cooking Tax

Corporate Income Tax

Goods and Services Tax (GST)

Death Tax

Driving Permit Tax

Environmental Tax (Fee)

Excise Taxes

Income Tax

Fishing License Tax

Food License Tax

Petrol Tax (too much per litre)

Gross Receipts Tax

Health Tax

Heating Tax

Inheritance Tax

Interest Tax

Lighting Tax

Liquor Tax

Luxury Taxes

Marriage License Tax

Medicare Tax

Mortgage Tax

Pension Tax

Personal Income Tax

Property Tax

Poverty Tax

Prescription Drug Tax

Real Estate Tax

Recreational Vehicle Tax

Retail Sales Tax

Service Charge Tax

School Tax

Telephone Tax

Value Added Tax

Vehicle License Registration Tax

Vehicle Sales Tax

Water Tax

Workers Compensation Tax

Tax (VAT) on Tax.

And Now they want a blooming Carbon Tax!”

Accounting and changing technology – an infographic

From time to time I come across some nice infographics which are worth sharing. Here is a good one which gives a brief summary of the story of accounting and technology change. If you can’t see it correctly, here is a direct link.

Source: Accounting-Degree.org

Management accountant’s travelogue – part 3 – to toll or not to toll?

As I drove through France and Spain on my holiday, I thought about the tolls one must pay (on most) motorways. I was thinking how do they set the prices of these tolls? Of course, public infrastructure like motorways is often now financed by a combination of public and private investment. Regardless of the investment type, can you imagine how tricky it is to pitch a price for a motorway toll. If it’s too high, less will use it (M6 Toll in the UK) and costs take much longer to be recouped. Set it too cheap and it floods with traffic, which in turn eventually results in less users, and that equals less money. Should the price be set with future investment and on-going maintenance in mind. Should it be a social good with a very low price – but then where will the money come from for re-investment? Lots of questions here, but I hope you can see a lot of management accounting is behind these decisions. I would imagine getting the initial price correct is the toughest part. Nowadays though, I am sure there are plenty of modelling tools to help toll operators and governments.