Opportunity cost – Gangnam style!

You have probably heard of Gangnam Style, – if not click here. Anyway, it broke Youtube’s counter in December and now has over 2.1 billion views. The video runs at just over 4 mins, which is 140 million man hours. Some writers at the Economist took a nice angle on Gangnam Style – the opportunity cost of us all watching it. You can read their post here, but can you believe we could have built 20 Empire State buildings, built 3 aircraft carriers or written the entire contents of wikipedia 1.5 times. It’s certainly an interesting take on the time we could have used to do better things.

What’s the cost of Christmas?

Ask any parent and they will tell you a lot! Given the time of year, have a look at this article which looks at the costs of the 12 gifts in the “12 Days of Christmas” song we all know.

Have a great Christmas!

The cost of “non-local” food

A while ago, I was asked to write some entries for an Encyclopaedia of Corporate Social Responsibility. I enjoyed this and the research behind the writing. One of the terms I wrote about was Local Food. Without repeating the definition verbatim, local food is basically food grown within a local area. But what exactly is local? Town, region, state, country or what? That’s the hard part.

The image to your right shows some nice juicy strawberries. When I was a kid, we had these as treats from about May to July. And they are a treat, once in season and local. But now I can get strawberries at Christmas – but they taste c**p usually and come from many miles away. This is definitely not local food.

Bringing consumers year round fruit (and other food types) is an expensive and difficult business. An article in the November edition of National Geographic gives some idea. Yes the example is US based, but it has some hard facts. The article follows the 3,200 mile journey of strawberries from California to Washington DC. The berries are grown on large-scale farms and over 500 trucks a day can be involved on just one farm. The retail value of each truckload is $90,000, and fuel for each truck costs $2,700. Total journey time is 80 hours, for which a driver must be paid etc, and think about the wear and tear of the truck. This is hardly a local food example I would argue, and it easy to see the money involved. And I’m not even starting on the true cost, which includes costs of large-scale farming (pesticide run-off for example) and CO2 emissions.

What is life cycle costing?

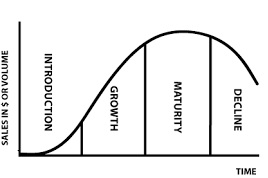

You may have seen the typical product life cycle graph in your previous studies (see left). The basic idea is that sales in money and volume increase over time, but gradually tail off as the product comes to the end of its cycle.

You may have seen the typical product life cycle graph in your previous studies (see left). The basic idea is that sales in money and volume increase over time, but gradually tail off as the product comes to the end of its cycle.

When we think of management accounting and product costing, we are generally looking at short-term costs, and not all costs a product may incur over it’s life cycle. For example, there may be advertising costs to boost sales of mature products, costs of product development or even remediation/disposal costs. Life cycle costing include all costs of a product or service from design to end-of-life. All recurring and once-off costs are included over the entire life cycle. These costs can then be compared with expected revenues to determine if a product is profitable or not.

To give you an example, consider the drug development life cycle. It may take many years and cost €billions to bring a drug to market (see here for example, which depicts the process at Bayer), before a single euro in revenue is earned. Then, there are the on-going manufacturing costs. Perhaps the drug has side effects, and needs some improvement during its life. And perhaps as the drug ends its life, there may be costs in dismantling purpose-built manufacturing facilities. Taking all these items (and more no doubt) a drug company can consider if a particular drug is profitable.

Simple graphical reporting

I have written a few posts in the past on the use of infographs to get a key message or statistics across to managers. While on holiday in Germany, I visited a now disused mine and I came across this:

It is a simple graph which shows the injuries at the mine for a nine month period. It does not need much explaining. What strikes me is its utter simplicity – it gets the number across in a clear and simple manner. It should be understood by all staff from managers to workers. It’s on a single page, and drawn manually – probably pre-dates computers.

CVP Analysis in action – the TGV

A few weeks ago I posted a piece on costs and profits when there is too much volume in the market. This post takes a look at the TGV (high-speed) service of SNCF. It’s in a spot of bother in terms of profit and management are considering various options.

I have been on the TGV several times. It is a fabulous service, but in today’s low-cost flight era it’s a bit expensive. And that’s exactly what a recent post from the Economist noted. According to the post, many TGV routes are no profitable. The reason for non- or low profitability is two-fold 1) increased competition from low-cost airlines who entice passengers with lower fares and 2) increasing costs paid to the rail track operator. SNCF management have apparently suggested three possible solutions, as follows:

1) decrease volume – i.e. reduce routes to those which are more profitable and attract adequate passenger numbers

2) increase volume, by lowering price. This could attract passengers back from low-cost airlines. It is a risky option though, as failure to attract enough passengers could worsen things

3) overhaul operations to be more like a low-cost airline i.e. become more cost conscious and efficient.

Which ever of the above three options are chosen, it is a classic case of the application of Cost-Volume-Profit (CVP) analysis. The costs and revenues will determine how profitable the TGV routes are, but so will the volume available. For example, using option 1 may improve profitability, but may not address costs or revenues. It may also be a bad option politically. Option 3 might keep service volume, but increase profitability and maintain pricing. And, as mentioned, option 2 might increase profitability if passenger volumes increased. It is not to hard to imagine a management accountant at SNCF using CVP techniques to show managers possible outcomes of each option.

CVP analysis – the effects of too much volume ?

Last summer I again took the car to Europe, using the Dover-Calais crossing. Not too long before I went I read an article about a UK Competition Authority ruling against one of the ferry operators – read here.

One of the operators is (now) owned by euro tunnel, hence the competition ruling. But let’s bring this to basic costs, volumes and profits. The ship I travelled on was almost empty, and as there is so much capacity on the route some operators are being pushed into a loss scenario. Why? Well, think about it for a moment – costs of running a large ferry are probably quite fixed. Prices may be low due to competition, but volume is relatively static. So, lowering price to attract passengers may be a loss maker. Similarly, too many operators may mean smaller passenger numbers for all, driving some into a loss situation.

So, as basic economics may dictate, ultimately one operator will fail as the market will force them out. And remember CVP analysis is based on a subset of the cost curves used in economics.

The cost of letting staff go……

As an accountant, when we think of the costs of letting staff go, we probably think redundancy costs and so on. These can be quite substantial. But maybe these short run costs are better than longer term damage costs. I know the example I give here may be less likely to work in Europe for employment law reasons, but I’m just trying to think about costs, not the HR side.

I read recently that Amazon (and others) are offerings employees a cash sum of up to $5000 if they wish to leave. Maybe this is a bit strange, but there may be an argument which suggests such a payment actually saves money longer term – employees who are not engaged with their company are probably less productive. I don’t know if companies like Amazon have done a cost analysis on this, but it seems to make sense.

To give another example, a few tears ago an employer told me that a substantial redundancy payment made to an employee probably was a good deal. The employee in question was creating a poor image with customers, which was starting to effect turnover. Again, maybe no cost analysis was done, but the short term cost of redundancy was compared with unknown longer term effects.

Break even in farming

Farmer’s, even if they know their costs, face a problem in that they can’t do anything about crop prices. If the price is above break even, it may even make sense to rent more land to grow more.

And of course, if a farmer knows the break even ‘cost’ per acre/hectare then they can try to get the best price above that.

Here is a good article showing the costs of corn this year, and working out a break even price. It’s a good example of the application of break even analysis.

More accounting tricks – Hollywood accounting

My last post noted some “tricks” used to make a budget balance. Here’s another story on how accounting tricks can be used to make something with huge revenues into a loss maker – it’s Hollywood accounting.

A $4billion budget trick

While searching the web for some blog material I came across this. It’s a great story about how some US senators played some tricks with various departmental budgets to plug a hole in another.

Costs of Goggle Glass

Here is a great post which highlights the costs of Google Glass. As I expected, the hardware costs are relatively small. These are, according to Google, small relative to research, engineering and other development costs.

Flat rate taxi fares, Hailo – reducing taxi costs?

I recently got a flat rate taxi fare from an airport in Europe – a bit of an adventure, the guy was really moving it. And the rate was of course cheaper than normal taxi fare which at airports are usually more expensive . So then I started to think about apps like Hailo (and the latest one Uber). Can these reduce taxi costs and in turn give us cheaper fares. Well I guess so. I don’t know for sure, but I would assume using Hailo is cheaper than “renting” a radio and a customer base from a taxi firm. If I’m right, will these reduced costs be passed on?

What is true cost accounting?

Image from 3bl media

True cost accounting (also called Environmental Full Cost Accounting) is a process which tries to identify all costs associated with a product or service. This includes not only the normal costs we would associate with a product or service, bit also social and environmental costs. It attempts include what economists call externalities – something which affects society or the environment but is not included in the market price of the product. Rather than me continue, here is a short YouTube video which explains the concept in a very clear way.

Does my milkman use Activity-Based Management ideas?

Not my milkman…

Ok, the title of this post is not really correct. It should be more like “does my milkman and his supplying dairy use activity-based management principles”? First, let me explain that where I live we still have milk delivered to our door twice per week. This is quite common in Ireland and has been happened for as long as I can remember. The only difference nowadays is that deliveries are no longer daily due to refrigeration technology improvements. Second, what is Activity-based Management (ABM)? In a co-authored text book (see burnsetal.com), ABM is defined as “The

use of ABC information to identify operational and strategic improvement possibilities”. We could extend this to say that ABM assumes a business manages itself based on activities (as in Activity-based Costing) rather than functions.

So what has this to do with my milkman? Well, despite its very traditional nature, technology has made its way into milk delivery. A new website (mymilkman.ie) has been set up by several dairies in Ireland to streamline milk delivery. Through the website, I can pay for my milk, change my order, pause my order if I go on holidays and so on. And when I signed up, I got €10 credit on my account.

I asked my milkman what he thought about the site. He told me that even if he gets only 50% of customers to sign-up, he will save 8 hours work per week. Why? Well he does not have to call to the door to collect money for one thing.

So what has this to do with ABM? Well the €10 credit on my account makes me think that someone is thinking that it costs less to manage a customer if online – and I would suggest this is a customer service activity. And if we think about it, how many businesses charge us more if we do things through call centres versus online for example. So there may be many businesses out there using the ideas of ABM – managing activities. But would they all use ABC? I doubt it. For example, the dairy industry probably used some form of process costing. Nevertheless, I think many businesses may use the basic idea of managing activities they perceive as costing more/less in different ways.