A new definition of accounting.

It has been a while since my last post, busy times. I hope to be able to get back to more regular posting now.

When I teach accounting to students for the first time, I typically draw on definitions which used words like “economic” and “communication”. Such definitions are of course a bit dated, and I typically provide more current insights on what accounting actually is, bringing in accounting for non-financial items and accounting for resources. I am always keen to emphasise the communicative element of accounting – it is after all data, transposed to information, and information is of less value if not communicated.

Recently Carnegie et al. (2021) published a really great commentary on what accounting is. As well as giving some very useful historic background, they provide a definition of accounting as follows:

Accounting is a technical, social and moral practice concerned with the sustainable utilisation of resources and proper accountability to stakeholders to enable the flourishing of organisations, people and nature.

Hats off, I cannot argue with the above, it captures what accounting is, or perhaps should be. I have been lucky enough to hear Gary Carnegie speak about the above definition, and he really presents a great case. The paper also poses the definition as something for debate and future work.

For what it is worth, my contribution to the debate is a simple one. The definition is fine, but let us not forget the word communicate and/or communication. Decisions in business can only be made on the basis of information, which should imply communication. Thus, perhaps as part of the operationalisation of the above definition, some notes or comments could re-affirm that communicate/communication is a must for accounting. It could of course be argued that “accountability” in the above definition implies communication. However, as a management accountant I can recall times from industry when communication could have led to accountability. A chicken and egg point perhaps, so let me put it another way. Accounting is a (not the) language of business, and while languages and meaning of words evolve (like accounting), they die out if not used to communicate.

Thanks to Garry Carnegie, Lee Parker and Eva Tsahuridu for kicking off what is an interesting and worthy debate.

The Templars and accounting

I recently finished reading The Templars by Dan Jones. The Templars are the stuff of legend in many texts movies, and Jones’s book is a great and detailed read on the history of the Templars.

As I did not know a lot about the Templars – outside of movies – I was surprised at how good they became at accounting. The Templars were a military order, founded in 1119 and remained active for about two centuries until their papal suppression in 1312. They were involved in several Crusades to the Holy Land, all of which entailed military and financial resources. It seems as a result of this and their well structured organisation, they became not only good at accounting, but so good they were trusted by others to hold cash assets on their behalf and act as a bank.

Jones’s book gives many insights from an accounting perspective, here are just two examples. A letter from 1220 written by Pope Honorius wanted to ensure that taxes collected to fund the Crusades did not flow via Rome. The Templars were thus used as agents to account for and deliver cash from tax collected to the Holy Land. A second example which appears throughout Jones’s book is how the Templars accumulated wealth as an order over time. They acquired land and similar immovable assets, and these were used productively to generate moveable assets – oil, wine and grains for example. All of this has to be accounted for and controlled. Jones also mentions how ultimately one way the Templars were hurt as an order – their wealth was attacked.

Accounting for Alcohol – part 2, optimism in accounting reports.

This post #2 in my summary of a recent edited book. This chapter by Alonso Moreno analyses the narrative information disclosed by a Spanish brewery, El Alcázar, from 1928–1992. The objective is to determine if the tone of the corporate reports is related to profitability. Today, the brewery belongs to the Heineken group.

The study focuses on a document entitled Memoria which is, in essence, similar to the Chairman’s Statement. Software was used to analyse the words in this report to determine the tone of the words. The tone (positive or negative) was related to other variables such as performance (profit) and the person acting Chair of the board. Over the full time period, there were more positive than negative references, irrespective of the actual performance of the company. This is a phenomenon called impression management and is something a lot of companies engage in still today. The interesting thing about this study is that overall, a positive tone dominates, despite many political events during the timeframe.

Cloud accounting providers – building on their data

Just a short post today – I will get back to more regular posts soon.

I have written before about several aspects of cloud accounting – see here for example. But we can also think about what cloud accounting providers can do for their clients.

Simply, these providers have lots of data and insights on their clients. The Intuit group seem to have been quite clever in recent years with such data – mainly in the US market though as far as I am aware. Here is their latest offering, offering loans to small business. If we assume the potential market is users of Intuit’s Quckbooks, then I could easily surmise that data – even aggregated – from the software could be used to assess the ability to repay and so on. If you are thinking there may be privacy concerns on the data, well I think any bank or lender would ask for financial statements regardless.

Food supply chain and accounting

In my daily work as an accounting academic, income across many papers and articles which explore the broader role of accounting in society and out daily lives. Lisa Jack from the University of Portsmouth writes about the role of accounting in the food supply chain. This is a very interesting area, as information on costs and margins is crucial in the food sector. She has just published an article on the recent contamination of eggs in some

European countries – you can read it here. It gives a good overview of how accounting is entwined in this and other food issues, and how it could help.

Fake news on accounting?

So, I was looking through Google News search to find something to quickly write for this post.

I found this article about the differences between IFRS and GAAP. I don't know much about the website, but the article has two incorrect statements. First IFRS does classify assets as current and non-current. Second, the term GAAP is more widely used that just referring to US rules. So, we could say UK GAAP or German GAAP.

Okay, so it's not fake news, but it's incorrect 🙂

Anglo Irish Bank – the circular transaction explained.

My colleague Michael Farrell has written a nice post explaining the dodgy accounting transactions at Anglo Irish Bank – the bank that was a big part of the Irish financial crisis in recent years.

Movies featuring accountants/accounting

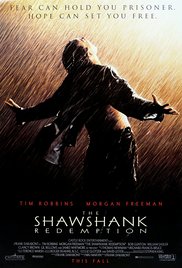

A few weeks ago, the annual Academy Awards took place. At some point in the run up to the awards, I found a nice post by Cheryl Meyer in the Journal of Accountancy. The post “5 films to inspire CPAs” was not only a reminder of some great movies, but also a reminder of the varying and broad role accounting and accountants play in society.

On favourite on the list is The Shawshank Redemption. If you have never seen it, do. The lead character Andy Dufresne (Tim Robbins) makes life a little more comfortable for himself while serving time through doing tax returns for prison officers and keeping accounts of the Warden’s corrupt dealings. The good accounting allows Andy to take all the corrupt cash for himself on his escape from prison.

My second favourite is The Untouchables. The model used to imprison Al Capone in this movie is still widely used today – get the criminals on tax laws or “lack” of earning to match their lifestyle. For example, the Irish Criminal Assets Bureau uses this concept quite effectively. I’m a big Sean Connery fan too!

The Pope’s view on accountants

A recent quote from Pope Francis to the World Congress of Accountants captures the broader role of accounting quite well:

” everyone, especially those who practise a profession which deals with the proper functioning of a country’s economic life, is asked to play a positive, constructive role in performing their daily work, knowing that behind every file, there is a story, there are faces.”

This quote reminds us that behind the numbers are real jobs, real people and real effects. It may be easy to forget this as you trawl over a ledger audit trail or provide information to managers, but reminding ourselves of the broad reach of our accounting numbers can only be a good thing.

The full text the address by Pope Francis can be found here.

What does off-balance sheet mean – Vatican off-balance sheet cash

In December 2014, the media (see here for example) noted how millions for euro were “off-balance” sheet. According to reports from the Vatican “some hundreds of millions of Euros were tucked away in particular sectional accounts and did not appear on the balance sheet”. So how can this happen, and what does off-balance sheet actually mean?

Let’s go back to basics first. A balance sheet shows assets, liabilities and equity. Assets are essentially something an organisation own’s or has use of like a owner; a liability is a claim against the business. Both must be measurable in monetary terms. So for example, many large firm’s brands have values in $billions put on them, but these are off-balance sheet assets which are off-balance sheet because the value cannot be measured accurately in money terms.

In other cases, such a the Vatican example, assets can be seemingly omitted from the balance sheet. This is of course not a recommended practice. How is this done? Well, it is a little bit more complex than this, but essentially something is omitted from the books of the organization. Remember, now matter how complex an organization is, underneath its accounting system is the good old double entry system of accounting. If a transaction (e.g. bank account) is omitted from the double entry accounts, that’s it, it does not appear on the balance sheet.

Anyone can call themselves an accountant

Yes it’s true, anyone – in Ireland at least – anyone can call themselves an accountant. And, this has been the case for as long as I have been an accountant. I was reminded of this recently by an article in the Irish Times. To quote from the article:

“Don’t fret, because no qualifications are necessary to trade as an accountant. Anybody can open up a practice, no matter how innumerate they may be – there are no absolutely restrictions on the use of the term “accountant”. Remarkable, isn’t it?”

I guess it is remarkable. Yes, there are professional accounting bodies whose members must pass examinations and keep their training up to date. And yes, to be an auditor you must generally be a member of such bodies. But after that anyone can claim to be an accountant. As noted in the Irish Times, even an upcoming review and consolidation of Irish company law has failed (as yet) to include a provision of who can use the term accountant.

Related articles

- So, you think you are an accountant? (irishtimes.com)

Accounting and changing technology – an infographic

From time to time I come across some nice infographics which are worth sharing. Here is a good one which gives a brief summary of the story of accounting and technology change. If you can’t see it correctly, here is a direct link.

Source: Accounting-Degree.org

Accounting – in the eyes of an 8 year old

A few weeks ago, my daughter asked me what exactly is it I do in work. My reply- I teach accounting. Now as, any of you with kids will know it never ends with a single question. So the next question: “What’s accounting?” And I think, damn. Ok, deep breath – how do I explain it. My reply: it’s about finding out how much money you make. Am I out of jail? Of course not. The next question was: how do you make money? Can you not just print more?. So, I ignore the second question as I don’t teach economics. My reply: you make money by selling something for more money that you bought it for. So the next question came back – can you always do that and make money? My reply: no. Next came a rhetorical question: well why do you need accounting then? If you don’t always make money, you don’t need accounting as you said accounting only tells you how much money you make.

Young minds – the clarity they have sometimes!

Do accountants have a sense of humour

Last month, I asked were accountants sexy. I walked by a chartered accountants practice (see the pic) in Maida Vale (London) recently and decided at least some accountants must have a sense of humour – despite the stereotype. If the owner is called Charlie ( as in Charlie’s Angels ) wouldn’t that be just great. Or maybe it should read financial angles?.

Is accounting sexy?

A few months ago, I was at a workshop which consisted of publishers/editors and accounting academics. I was a bit late and when I arrived one of the editors asked me to introduce myself as follows ” tell us a little bit about yourself, where you are from and what makes accounting sexy?” First two questions, no problem. The last one, well thankfully I am a CIMA member and remember the series of adverts in 2004 from their Financial Management magazine. The ads (see the picture to the left) were for accounting software and featured a dominatrix and the caption “is your procurement strict enough”. I loved that ad! In one foul swoop it got rid of the dull and boring stereotype of accountants. Of course, some CIMA members did not like it at all and wrote to the editors. This complaining perpetuated the dull image of accountant and inspired a further article entitled “Miss Backlash” – see here.

So now for a completely unscientific experiment – I show just a few examples by the way

1. If I Google “is accounting sexy”, I get a good few interesting results:

A blog, accountantsaresexy.com – a bit dated

A blog post with the title The Surprisingly Sexy Chart of Accounts

A you tube video, JustThrive Makes Accounting Sexy – YouTube

2. If I google “sexy accounting”, I get some similar results to #1

I also get some pretty dodgy stuff.

3. If I google “sexy accountant”

The results are getting to beyond a PG rating! But a quick glance at the image search result throws up this ! You can decide for yourself on the sexiness (or otherwise).

So is accounting sexy? I don’t know to be honest, but I hope this short reflection puts a smile on your face. Now back to those ledgers……

(If you want to know more on the images of accountants, check out the work of Baldvinsdottir et al)